The business expenses budget is the one that comes right after the direct labor budget. The reason the latter takes precedence is that it is necessary to know the budgeted direct labor hours to establish it.

Thus, by knowing the hours of direct labor budgeted, we are able to establish the total indirect manufacturing costs and then we can forecast the total disbursements for these.

Free Business Expenses Budget

What is a Business Expenses Budget?

With budgeted direct labor hours, the business expenses budget can be estimated.

The business expenses budget forecasts the total cash outflows for manufacturing overhead, as well as the pre-determined charging rate for the period.

The first step is to define the total manufacturing overhead. Then, we subtract the expenses involving no real cash outflow, for example, depreciation. Thus, we obtain the disbursement of a period for the manufacturing overhead.

The rest of this article shows how to budget manufacturing overhead.

How to make a budget for indirect manufacturing costs?

As with all other budgets, we have set up a free Excel file to establish the budget for indirect manufacturing costs.

A manufacturing overhead budget is calculated by multiplying the direct labor hours budgeted by the variable manufacturing overhead allocation rate. The result of this multiplication represents the variable indirect manufacturing costs and by adding the fixed indirect manufacturing costs, we obtain the total indirect manufacturing costs.

To obtain the disbursements relating to indirect manufacturing costs, all that is needed is to subtract the expenses having no real cash outflow.

To allow you to visualize the indirect manufacturing costs budget, here are the explanations relating to the free business expenses budget that we have designed.

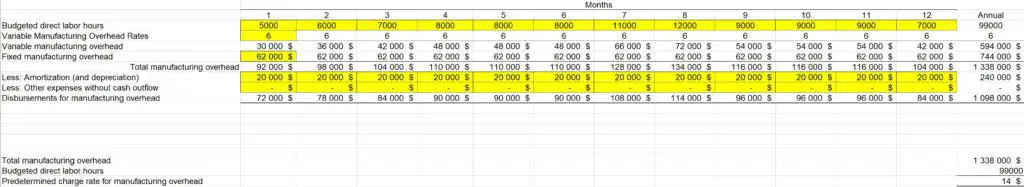

Here is an image that shows the entire manufacturing overhead budget that we designed.

(Tap on the image to enlarge)

The first step to setting it up is to include the budgeted direct labor hours which are defined according to the direct labor budget. We do this because variable overhead depends on direct labor hours.

Then, we must include the variable manufacturing overhead charge rate.

According to Michel Vézina of HEC, to determine the charge rate, we divide the budgeted indirect costs by the level of activity planned according to the charging base.

This allocation base must be chosen. Mr. Vézina mentions that to choose the imputation base, one must evaluate the possible imputation bases. Here are some examples:

- The number of units sold/manufactured

- Turnover

- Quantities or cost of raw materials used

- Direct labor time or cost

- The number of hours per machine

- The surface used

Thus, you need to think about the most suitable method for your business. After you set the variable manufacturing overhead charge rate, the variable manufacturing overhead will be set automatically.

Next, you need to add the fixed manufacturing overhead. Subsequently, the total indirect manufacturing costs will be calculated automatically.

The set of budgets makes it possible to obtain all the cash inflows and outflows which are presented according to the cash budget.

For its part, the budget for indirect manufacturing costs presents the disbursements for indirect manufacturing costs. They are the result of the total indirect manufacturing costs minus the expenses with no real cash outflow. The most frequent is depreciation and you must insert it in the Excel file.

By having completed all the boxes in yellow, you will automatically obtain the predetermined charge rate for indirect manufacturing costs.

Free Business Expenses Budget

A logical continuation of the indirect manufacturing costs budget

At this stage, you should have completed the sales budget, the production budget, the direct labor budget, and now the business expenses budget. Now another budget stems from the production budget. This is the raw materials budget.

If this has already been completed, you must then complete the finished goods inventory budget at the end, as well as the sales and administrative expenses budget and the investment budget.

The whole of the work will allow you to establish the cash budget.

In short, we hope that these budgets will be useful to you. Please note that this website allows you to learn more about all subjects related to business finance.

Bibliographic sources: