When we are interested in the management ratios of a company, it is to see the performance of the managers concerning their management.

Like any financial ratio, the quality of management ratios depends on the industry in which the company operates, as well as the size of the company (usually assessed by revenue).

Thus, we present to you the 7 important financial ratios relating to management.

What are a company’s management ratios?

Accounts receivable collection time

When the company makes a sale, it does not always receive the money from the sale immediately. We often see companies having to wait a certain time before receiving the money from the sale. The amount that has not yet been reimbursed by customers appears under current assets on the balance sheet. These are accounts receivable.

The calculation of the accounts receivable collection time provides the average number of days before the company receives the money relating to its sales made on credit.

Here is the formula used to calculate the accounts receivable collection time:

We use a multiplier by 365 so that the result is the number of days. Thus, by respecting the formula, we obtain the average number of days that it takes the company to recover its accounts receivable.

To optimize its cash management, the company wants to receive its accounts receivable as quickly as possible, because this allows it to have access to its cash sooner.

On the other hand, we cannot say that a company is not optimal when it has a long collection period for accounts receivable. It depends on the industry in which it operates.

However, it is possible to quickly form an opinion on the performance of contractor management by comparing the collection period for accounts receivable with the payment period for suppliers and including the inventory turnaround time.

Before explaining the relationship between these ratios, let’s start by defining these other ratios.

Supplier payment time

Unlike its accounts receivable, the company can obtain credit from its suppliers. This is called accounts payable and these are shown as current liabilities on the balance sheet.

The supplier payment term provides the average number of days before the company pays what it owes to its suppliers.

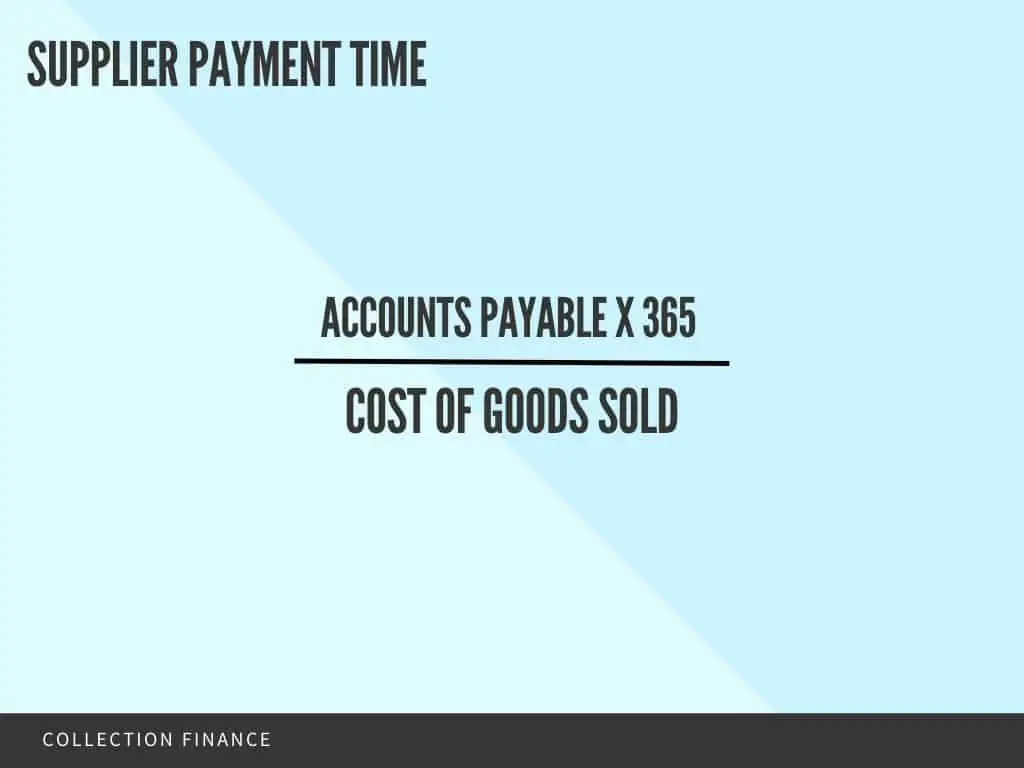

Here is the formula used to calculate the supplier payment term:

Typically, the business wants to push supplier payments as far back as possible, as this allows it to conserve cash, which is beneficial for cash management. For certain reasons, the company could be inclined to pay its suppliers quickly. For example, to take advantage of the discount generally offered by suppliers when payments are made quickly (we often see a 2% discount if payments are made within the first 10 days). Sometimes, the company does not want to deteriorate its relationship with its suppliers.

Inventory rotation

Stocks or inventories are the products that the company has purchased from its suppliers and that it wishes to resell to make a profit. Inventories can be raw materials, work in progress, and finally finished goods.

The inventory rotation calculation helps to know if the company maintains a sufficient amount of inventory.

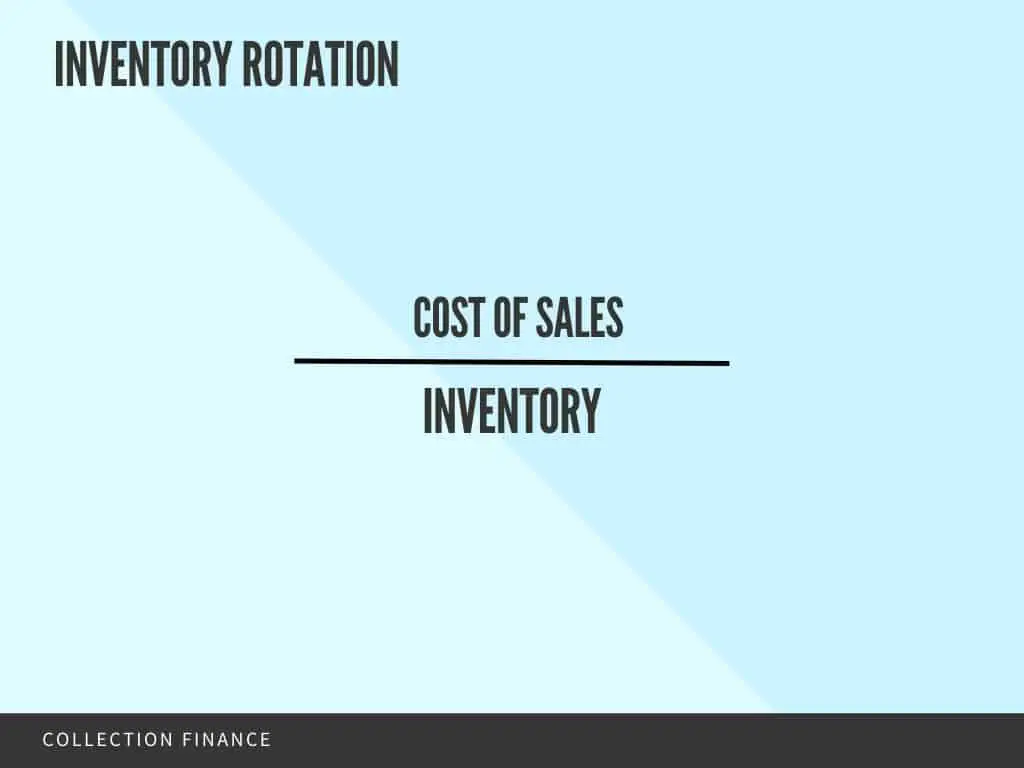

Here is the formula used to calculate inventory turnover :

As a general rule, the higher the inventory turnover, the more optimal the company’s invested capital, since in this case, it revises the color of its investments more quickly. In some cases, a high value may indicate that the company is having difficulty meeting demand.

This ratio is calculated on a specific date according to the company’s financial statements.

Inventory turnaround time

As a follow-up to the previous ratio, the inventory turnaround time comes to generalize quantifying in days how much time will be needed before having to receive new inventory.

The inventory turnaround time indicates, on average, how many days the company needs to renew its inventory.

Here is the formula used to calculate inventory turnaround time:

In the analysis of these two ratios, it is essential to take into account the inventory valuation method. If this is not the same, then it is difficult to compare the companies between them.

Cash conversion cycle

In terms of cash management, a company’s goal is to have access to as much cash as possible. One can easily imagine the cash conversion cycle by wondering when the sums invested will finally be transformed into cash.

The cash conversion cycle measures the time it takes, on average, for the business to convert inventory into cash.

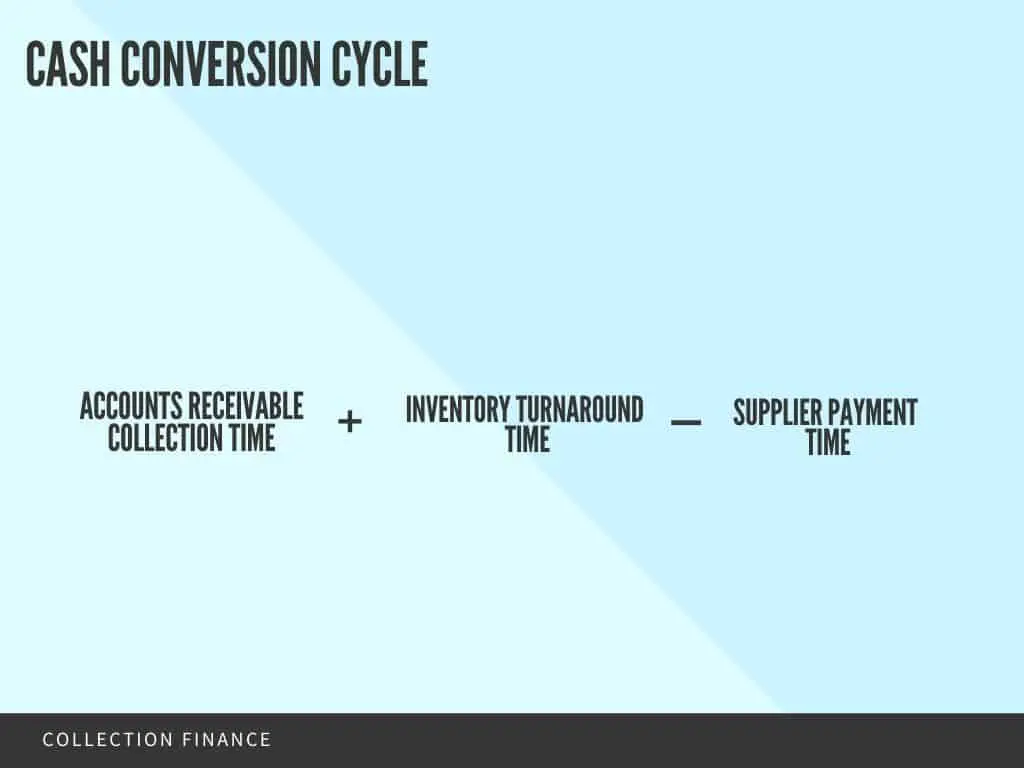

Here is the formula used to calculate the cash conversion cycle:

The company pays an amount when it buys its inventory. To review the sums invested, the company must successfully sell its stocks and recover the sums relating to the sale. Thus, by adding the inventory turnover time to the accounts receivable recovery time and subtracting the supplier payment time, we obtain the time required to convert inventory into cash.

To understand the meaning of this calculation, let’s start with inventory turnaround time. This tells us after how many days the company renews its stocks. In other words, this lead time represents the average time it takes for the business to sell everything it has in inventory. Then she has to place another order according to this theoretical moment.

Thus, from the moment the order is received, the calculation of the cash conversion cycle begins taking into account the number of days elapsed. The company must sell its products and collect the money, so the time to collect accounts receivable is added to the time for inventory turnover. In addition, the company must pay its suppliers. We, therefore, subtract the number of days required for the company to pay its suppliers.

The cash conversion cycle is not perfect, since it is based on theoretical calculations and uses averages. However, it gives a general order of magnitude, which gives an idea of the speed of conversion of inventories into cash.

Fixed Asset Rotation

This ratio makes it possible to know what is the number of dollars of sale that was made per dollar of fixed assets.

Fixed assets rotation shows how productive the firm’s assets are.

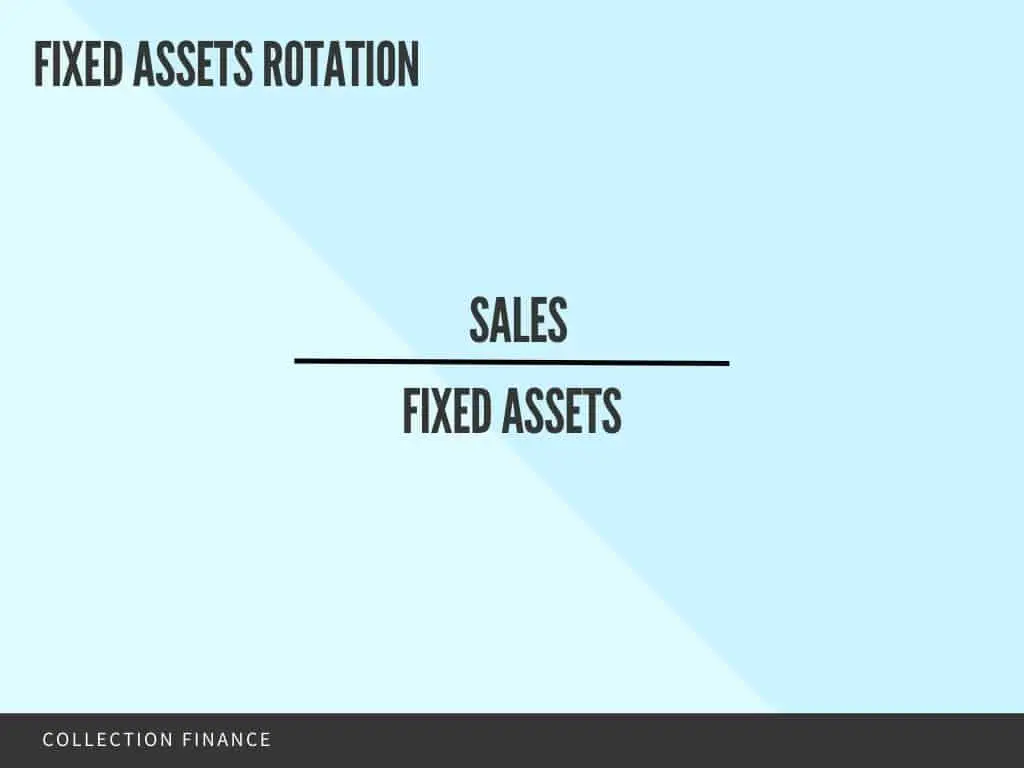

Here is the formula used to calculate asset turnover:

By calculating this ratio, we can see the quality of fixed assets to generate sales. Thus, the higher this ratio, the more productive the fixed assets.

Conversely, having a low ratio shows that the dollars invested in fixed assets may be too high.

We keep in mind that the objective of the company, according to the contexts that we describe, is the maximization of the sales of the company which seeks growth.

Asset rotation

This is similar to the previous ratio, except that instead of considering only fixed assets, all assets are included.

Asset rotation shows how productive the company’s assets are.

Here is the formula used to calculate asset turnover:

By calculating this ratio, we can see the quality of the assets to generate sales. Thus, the higher this ratio, the more productive the assets.

Conversely, having a low ratio shows that the dollars invested in assets may be too high and unnecessary.

Bibliographic sources: