The cash budget or treasury budget includes all the budgets, forming part of what is called the master budget. It acts as a summary of all cash inflows and outflows of a business.

Free Cash Budget

For its part, the master budget also includes all budgets, except that it also includes the provisional financial statements.

For the sake of understanding, here is what the master budget of a manufacturing company consists of:

(Tap on the image to enlarge)

*Image adapted from Garrison, R. Libby, T., & Webb, A. (2016). “Foundations of Management Accounting”, Chenelière Education.

We bring your attention to the cash budget in the image above. You will notice that all the budgets are linked to it by acting as inputs.

In addition, we see that the output of the cash budget allows the implementation of the provisional income statement and balance sheet.

As we will further explain in the “How to make a cash budget” section, the latter differs according to the type of business (production, commercial, service).

Any business manager who wishes to control the cash management of his business must budget.

In other words, understanding when your business will experience an inflow or outflow of funds allows you to plan your activities.

Before going into the details, let’s start by looking at the advantages for your company of making a cash budget.

What are the advantages of the cash budget?

The advantages of the cash budget are:

- Easier to get financing

- Better financial planning

- Improved decision making

Now, let’s further explore the benefits of cash budgeting.

The quality of your relationship with your banker is crucial to obtaining the financing necessary to carry out your projects.

When you do business with a financial institution, an account manager is responsible for meeting with you to discuss your plans.

When he judges that the project is potentially feasible, he asks you to prepare documents that will allow his team to put together a funding request.

Generally, credit authorizers at the same financial institution are responsible for assessing the risk of your business to be able to accept or refuse the new request for financing.

To be able to make a decision, the authorizer must understand your business. He must also ensure that your company will still be able to make its payments despite the new request for financing.

We are therefore talking about the repayment capacity of your company. The repayment capacity that is assessed by the authorizer includes your new application for financing.

The authorizer tries to understand the future of your business. Assessing the future can be complex because the past does not guarantee the future.

What will greatly help the financial institution to grant you financing is the clarity of the information that you transmit to it.

A cash budget improves the quality of information provided, which increases your chances of obtaining financing.

There is no certainty that you will obtain the desired financing, even if you achieve a cash budget. On the other hand, you have to be aware that a financial institution is always conservative in its approach.

In other words, the financial institution wants to take as little risk as possible. It must assess the risk to your business and when the quality of the information is ambiguous, then it will be conservative and retain the worst-case scenario.

Thus, by carrying out a cash budget, you help the credit authorizer by showing him quality information on your future repayment capacity.

Running a business requires managers to constantly make financial decisions for the survival of the business.

Short-term financial management must be closely monitored to allow the company to have the liquidities necessary to make its payments, and this, at the right times.

Lack of liquidity is one of the main financial problems for companies.

Cash management using a cash budget helps to avoid cash shortages that usually lead to significant issues with stakeholders, e.g., financial institutions, suppliers, etc.

Better financial planning will be put in place thanks to the cash budget, so you will be able to establish provisional financial statements, which will then allow you to compare the budgeting to reality.

The more adequate your business financial planning is, the more problems will be limited. Along the same lines, you will also notice an improvement in your profitability, as you will be much more aware of cost management.

In addition to improving financial planning, the cash budget allows for better decision-making. By having a good general idea of what is coming for the company, managers will be able to make more rational decisions.

For example, the purchase of new equipment could be delayed if the cash budget shows significant short-term liquidity pressures.

There is always a portion of the future that is unknown, even if your forecasts are excellent. On the other hand, reducing the level of risk through a good understanding of budgeting allows you to make so-called “smarter” decisions.

The cash budget allows you to foresee the near future of your business. By completing it regularly and diligently, you have the opportunity to adapt your decision-making to your forecasts.

There is no certainty as to the accuracy of the cash budget, however you will have a good general idea, which will improve your decision-making in the long run.

Now that we’ve seen the benefits of this tool, let’s see what a cash budget is.

Free Cash Budget

What is a cash budget?

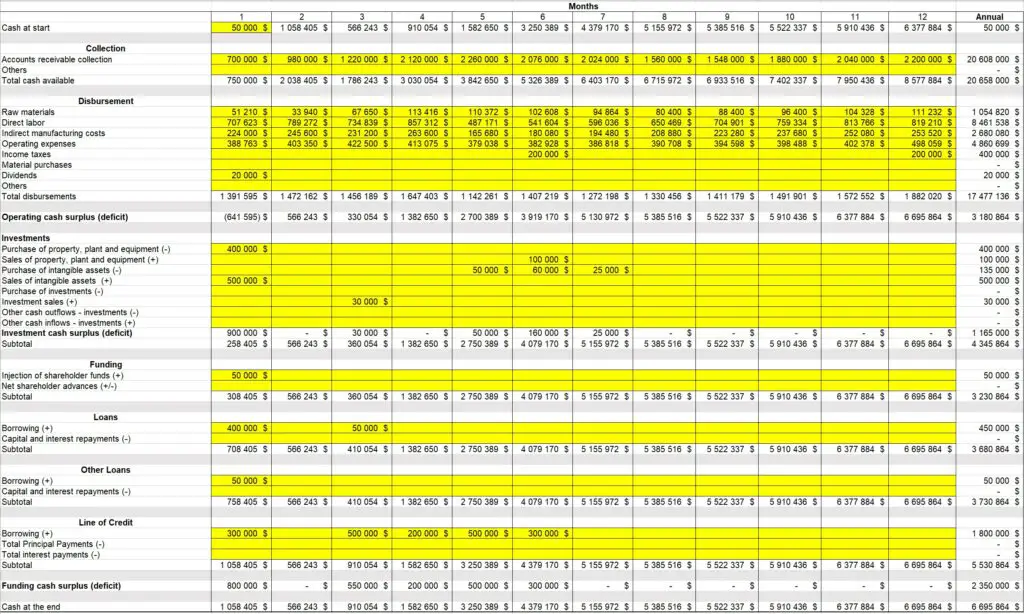

As we mentioned earlier, the cash budget includes all budgets. This is the last step before being able to draw up projected financial statements.

In general, the cash budget makes it possible to budget the financial inflows and outflows of a company, which leads to a cash surplus or deficit for a given period.

By drawing up all the cash inflows and outflows according to certain periods, the financial managers can forecast the needs for using the line of credit, the requests for financing, or any other funding in the company.

Since there are several types of businesses, the cash budget can vary depending on the nature of the business’s activities.

The cash budget is similar for all companies, but certain parts are added or removed depending on the industry.

Thus, we can divide the cash budgets into three categories:

- Cash budget for a manufacturing company

- Cash budget for a commercial company

- Cash budget for a service company

The rest of this article will help you understand how to establish this budget specifically for your business.

How to make a cash budget?

As we mentioned above, a cash budget should be specific to the type of business you run.

Doing a cash budget requires setting up a set of budgets that will determine what your business’s cash inflows and outflows are, while also considering the cash inflows and outflows relating to the purchase and sale of fixed assets, financing, and other funding capacities available to the company.

As you will have noticed in the image at the beginning of this article which demonstrates the master budget of a manufacturing company, there are several steps to achieve a master budget

The manufacturing company is the one with the most steps for establishing the master budget.

The commercial company has a little less, because it does not have to manufacture, so it does not have to make production budgets, raw materials budgets, direct labor budgets, and indirect manufacturing costs budgets. Instead, these budgets are replaced by a commodity purchase budget.

For service companies, since the majority of them do not have inventories, then it is generally not necessary to establish a budget for the purchase of goods. Since every business is different, if you find it necessary to produce one and it would help your budgeting, then you know what you are doing.

That being said, please note that this article explains how to do a cash budget, but it does not explain how to do all the budgets that allow you to obtain the data to carry out the cash budget.

If you want to realize each of the budgets that allow the realization of the cash budget, then you can follow the links in the table below. These redirect to other comprehensive articles for each of the budgets. On the other hand, if you wish to see the result of all the budgets, then the rest of this article details the whole of the work.

| Manufacturing Business | Commercial Business | All Businesses |

|---|---|---|

| Production Budget | Inventory Budget | Sales Budget |

| Raw Materials Budget | Goods budget | Operating Cost Budget |

| Labor Budget | Cash Budget | |

| Expenses Budget | ||

| Inventory Budget |

Components of the cash budget

The cash budget is made up of several parts generating cash inflows and outflows.

Beginning with cash at the start of the period and ending with cash at the end, the cash budget adds and subtracts all cash inflows and outflows to reflect the impact the period will have on the cash flow of the company.

A cash budget is similar to a projected cash flow statement.

First, the collection portion includes the collection of accounts receivable and all other sales.

Then, the disbursements stage groups the disbursements relating to all the budgets. In other words, a disbursement is provided for raw materials, direct labor, selling and administrative expenses, etc.

In addition to disbursements relating to all budgets, the disbursements portion of the cash budget includes disbursements relating to income tax, dividends, and other disbursements.

Through receipts and disbursements, one obtains an operating cash surplus or deficit for a certain period (usually monthly or quarterly).

Subsequently, the investment section of the cash budget shows an outflow of funds for purchases of tangible or intangible assets, investments, or any other investments.

Conversely, sales of fixed assets, investments, and any other sale of investments generate an inflow of funds.

Thus, we obtain the cash surplus or deficit of investments.

Now, a part is devoted to financing. It includes cash inflows and outflows relating to the following financing:

- Fundings of shareholder

- Advance from shareholders

- Loans

- Line of credit

- Other borrowings

We then obtain a cash surplus or deficit relating to the financing of the company.

Then, we add to the cash at the beginning the sum of the three main items, that is to say:

- Operating cash surplus (deficit)

- Investment cash surplus (deficit)

- Funding cash surplus (deficit)

This is how the cash is obtained at the end of the period. The latter becomes the cash at the beginning of the next period and so on.

Free Cash Budget

Bibliographic sources: